“The new generation of Mrs.Watanabes and Investing today in Japan”

Interview with Four Ships Founder and CEO, Yashwant Bajaj. Yashwant Bajaj was Head of Equity Sales Tokyo. Kleinwort Benson Securities Japan (Dresdner Kleinwort Benson from 1997), Japan, Tokyo, 1994 – 1998. He was then MD Lehman Brothers from 1999-2004 where he was Member of Asian Equity Executive Committee . Head of Japan Cash Product and Global Head of Japanese Equity Sales. He then was the Founder and Principal of Hachiman Capital Management 2004 –2010 with 5 years top quartile performance with peak AUM of U$200 million and then Founder and Principal of Juggernaut Capital Management from 2011-2013 that was nominated Best New Asia Hedge Fund in 2012 by Eurekahedge. He recently started a new hedge fund in 2019, Four Ships, based in Singapore focused on “Japan in Asia Opportunities”.

AV: Given some positive structural changes in Japan such as: improving corporate governance and “womenomics” and a positive catalyst such as the 2021 Summer Olympics, is there still an underinvestment in Japan and why is this the case?

YB:

There has been a long-term underweight investment in Japanese equities actually going back decades: This even predates the bursting of the Japanese “bubble” in 1990. Foreign investors actually went underweight in 1987 when they couldn’t stomach valuations nearing 20,000 on the Nikkei in 1987 before it proceeded to 38,917at the peak in 1989! In more recent history, foreign investors really started net selling Japan interrupted by short upticks of buying about 2 years into Abenomics in 2015 . Structural issues have been a tough headwind to overcome to justify reversing this position:Persistent deflationary pressures, ageing population, poor Public sector fiscal position andmarginalization of Japanese companies in a number of industries by Asian competitors have led to lower comparable growth.Poor corporate governance and barriers to M&A relative to other developed economies has made Europe more favoured as a developed economy investment alternative to the US. Throw into the mix periods of trade friction with the US and more recently with Korea and bouts of yen strength and the current mindset of foreign investors has significant inertia to overcome in shifting from a typically long held underweight positioning.

Thus, recent periods of overweight behaviourin Japan have either been tactical (eg Euro crisis ) or policy expectation driven (Koizumi period, Abenomics) which have ended with littleperceived real structural change, leading to more entrenched underweight long-term positioning. Another factor leading to underweight positioning has been opportunity cost: Unlike the early 2000s when Japan was the 2nd largest market in the world and most liquid in Asia, the growth of China and more recently India have crowded out Japan investment on an opportunity cost basis. Asia allocations are typically within “Asia including Japan “.Standalone Japan investment is generally confined to domestic financial institutions and retail investors.

Source MOF

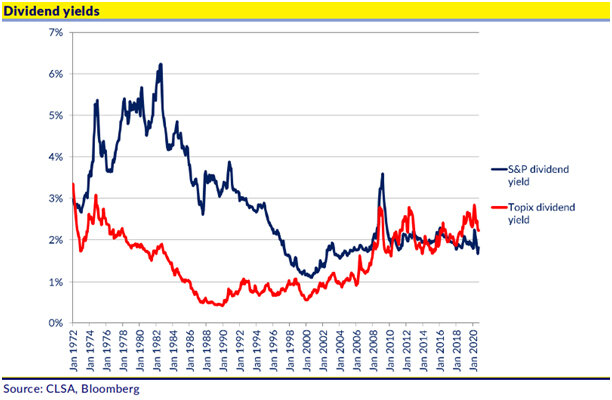

I believe that structural change in Corporate governance in Japan is real and is battling the entrenched positioning described above borne of historical disappointment.One example of this is the improved dividend growth of Japanese companies. Between the peak of the last cycle in FY 07 and the recent peak in FY19 dividends paid by Topix 500 companies increased by 93%. Share buybacks for Topix companies rose 157% over this same period. This situation is likely to be only temporarily interrupted by the COVID crisis (if at all). Since FY05 Topix 500 non-financials have grown book by 90% against a 39% increase in sales.

Thus, in my view pressure to pay this out rather than retain further earnings post COVID is likely to increase rather than dissipate.

As far as “ Womenomics” I remain less convinced. Although the policy headline fufills a narrative of diversity which is a policy essential for functioning democracies Japan still lags significantly in implementation. The Japanese government Abenomics web site boasts that the number of Japanese women entering the workforce increased by 3 million from 2012 to 2019 and that women in the private sector with management jobs is approaching 10%.However, the no of hires has been in line with an overall tightening of the labour market to record levels, skewed to part time hires and only 5.3% of board directors in Japan are women vs 32% in US Fortune 500 companies. The comparison is actually poor vs other Asian countries as well.

Source: McKinsey

The Olympics at this point appear likely to be scaled back or more likely cancelled. A severely limited offering is likely to risk a loss of face on a global stage for Japan and would likely be avoided at any cost. Participating nation nonattendance could be a conduit to cancellation without such a loss of face. The current official outward positive stance towards staging to show strength in the face of adversity (COVID) is both implausible and impractical.

AV: Shushin-koyo or lifetime employment model remains common, especially among big firms. This scheme penalizes part time workers due to stress on the pension funds. How can current entry level Japanese workers, men and women compete within this system?

YB:

The simple answer is that they can't. The nature of the social contract in Japan post second world war was designed implicitly to protect workers from economic risk in an economically damaged and rebuilding Japan. This stability allowed employers to keep collective wage bargaining to below other developed nations as workers sought employment stability over personal income. The bursting of the bubble and subsequent deflation Japan suffered prolonged this situation. In the deflationary period of the 90s companies cut costs but did not address labourcosts, a standard means of restructuring in the west. The resulting bloated cost structure resulted in a the “lost decade” and creation of “zombie” companies with the Japanese banking sector ultimately picking up the tab and restructuring in the early 2000s.

The further consequence of this was that these companies have been limited in ability to make full time hires since then. Another major consequence was pressure to pivot to the Service sector particularly New Advanced Technology as a source of growth andhence employment also did not occur in the way it did in the west in the 90s and beyond as result of the hollowing out of traditional manufacturing.

Prime minister Suga’s “Digitilisation” economic policy push is part of a catch-up process that may accelerate service sector hiring. The drawback is non “Keiretsu” firms still are at a disadvantage in financing in Japan and thus companies have so far chosen growth partly through flexible employment practices through part time employment hires over organic full-time employment growth. The scope for growth here (as are the challenges) is significant.

All this must be couched in the current situation where the working age population of Japan is set to decline from 79 million in 2012 to 71 million in 2025 potentially diminishing the competitive capabilities of the current corporate structure in Japan. Either wages will have to go up, companies will have to hire as natural attrition will be deepening or foreign skilled labour employment will have to increase significantly. Most likely all three in my view.

AV: Given your seasoned experience on both the buy-side and sell side in Japan, and the backdrop of aging demographics, increasing public debt as a % of GDP, and deflationary bias, what makes the Four Ships approach different from other Japanese focused funds?

YB:Most Japan L/S equity funds currently available fall into one of the following two camps:

-

1. Diversified long bias bottom-up “stock pickers” . Most are lower volatility near market neutral servicing a Japanese or typical platform lower volatility with target returns at 10% but in practice achieving single digit returns with a Sharp ratio not much north of 1.

Alpha is generated byinvestment timing around catalyst “events” – the most common being quarterly earnings.A lot of them have an inherent market cap skew favouring small cap companies on the long book offset by larger capitilisation names in the short book or a short book that is bulked with ETFs and/or futures to lower the overall net exposure of the fund.

This approach has serious pitfalls. The level of diversification– typically over 100 names and limited focus on the short book gives no protection from a correlated market move in a market “shock” such as March this year. This is not confined to just price performance but also liquidity risk and hence realizable value of the portfolio in such circumstances.

For my new Fund having managed a small-mid cap L/S fund previously and lived through the challenges in a prolonged downturn post 2005 , although keeping a relatively tight net exposure range (-30-+30%) and leverage (130-140 gross upper limit) I confine myself to a larger , more liquid matched long and short market cap universe with fewer counters and greater dependency on short book alpha than what is currently available. I also run slightly higher volatility (8-10%) giving me the necessary volatility budget for 15%+ returns.

The higher volatility mainly derives from a more concentrated portfolio of 30-50 names. Where I have an experience edge.

Infact experience edge is I believe an important differentiatorfor me having worked in the Japanese stock market since 1985 and on both sell and buy side, and managed two Asia Hedge award nominated hedge funds for 10 years in the space previously. The length of experience also means that I have decades of corporate access with companies who are familiar with me which helps in access to senior management. As a business operator for my fund having been a senior manager on the sell side also helps me with relationships with service providers and operational risk management of the fund.

Having lived and worked in Japan for 15 years I understand the importance of the local approach to investment and sources of information on the ground and have a developed network. I also believe that is important to have an “Outside in” understanding of Japan in context with alternatives in Asia and the rest of the world from a competitive, end market and ultimately valuation, catalyst and opportunity basis for its companies. Most competitors have either one skill set or the other not both.

Also,a major philosophical differentiator is that unlike most of long-term experience competitors I am not unequivocally bullish on Japan. Japan faces serious issues on many fronts which provides abundant short book opportunities still. I have no problem in implementing and maintaining a net short position in the portfolio when required.

-

2. Corporate governance focused “Activist” Funds. These are long only strategies that are attempting to catalyse the positive developments in governance in Japan described above. The reality however is that 100% of the proposals at the most recent round of AGMs this year from Activist Funds were voted down. Also, news from Nissan and their handling of Carlos Ghosn and subsequent dividend policy, the apparent exit from Sony by Third Point as well as Softbank’s diversion to US equity option trading hasn’t assisted returns and incremental investor appetite for such an approach.

My personal view is that although governance is real returns can still only be tangibly harvested by aligning yourself with the currently politically possible, which in effect means aligning yourself with rather than against incumbent management behaviour where this is accretive to minority shareholder returns. Thus, I participate for example in parent -subsidiary M&A trades which is accelerating in Japan and target company returns have been significant. Having relative value pair trades also helps to dampen down my overall volatility.

Corporate hostile M&A is also an exciting new development in Japan which bodes well for value realization and more broadly Value style investment although this has been confined to mainstream

AV: Describe the level of Herding Bias and Indexation Common among Japanese Investors?

YB:

Indexation has rapidly been increasing in line with trends in the US. Net assets invested in Index funds in Japan overtook the amount managed in active funds by the end of 2019 . They did this in the US last August. The amount in index funds in Japan grew 29% in 2019 to 50.95 Trillion yen ($482 Billion) versus 6% growth for active funds to 43.95 Trillion yen ($416 Billion). The amount in index funds has tripled in the last 5 years fueled by a continued lower interest rate environment spurring individuals to increase retirement savings rates with lower fee structure vehicles and Bank of Japan ETF purchases. If you exclude BOJ purchases the increase is 70%.

Although peers have complained about the undermining of a “Stock Picking “approach by the growth of indexation the demand for uncorrelated hedged alternative products by Japanese financial institutions is growing rapidly for Japan investments where AUM in the HF space is extremely limited currently and a number of offerings are biased to beta rather than alpha.

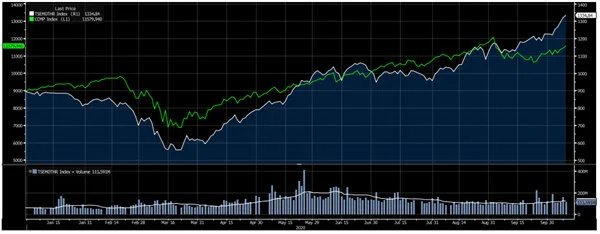

Japanese retail investors have historically herded investmentstyles,towards growth investing in smaller capitalization companies. The availability of online trading platforms with expanded functionality has seen online retail volumes rise to be as high as foreign turnover (about 40%) of total Topix turnover. This number has risen as it has globally this year during lockdown in the COVID crisis and has yet to abate.In the lowest barrier to listing growth MOTHERS market retail activity predominates at over 80% of turnover with the resultant individual stock and index volatility being much higher than Topix. It is worth noting that the speculative trading and gains in MOTHERS actually is significantly larger than NASDAQ performance YTD(+ 49% vs +29 % ).

Mothers Performance vs Nasdaq YTD

Source : Bloomberg

Base Inc (4477) vs ZOOM US YTD

Source : Bloomberg

AV: How far is the US in terms of mirroring Japan in terms of deflationary pressure on the economy and thus overall inability to service the debt?Also, the Federal Reserve has already bought US corporate bonds amidst the pandemic similar to the Bank of Japan? Will we see a scenario that the Federal Reserve will also purchase US ETF’s or straight equities similar to the Bank of Japan?

YB:

In June 2009 I was asked by Pension allocators from the World Bank in my office what I would expect to be the best investment over the next 24 months. I replied that if the Japan model was to be followed from the post 1990s banking crisis in Japan and recapitalization in 2003 then US government bonds, or infact sovereign bonds in general would provide the best risk adjusted returns to investors. At this point again 6 months into a recovery from another global crisis 11 years on with zero or negative rates globally it is hard to conceive that this would still be the optimal choice. However, there are a number of reasons to think that deflation will not be an issue in the US. Firstly just as the US Federal reserve acted to avoid a Japan type scenario ( partly as Ben Bernanke was extremely familiar with it having written his PHD thesis on it) by preemptively recapitalizing the banking sector early into the GFC the FED has again taken preemptive action : This time to add record amounts of liquidity into financial markets and thus avoid a Corporate debt work out that deteriorating funding conditions would have precipitated for the Corporate sector as a result of the catastrophic collapse in revenue resulting from COVID lockdown measures . The real risk was a Japan style deflationary work out from a record high levered Corporate sector on the lines of the bursting of the bubble in Japan in the 1990s.

However, there are a few important differences. Firstly, the level of debt although at record levels was not comparable in scale to that of Japan in the bubble. Secondly Capital ratios at US banks are in no way comparable to Japanese banks going into the bubble burst. The third factor is that US dollar is the worlds reserve currency and 52% of global trade is conducted in US $. This provides a cushioning to any deflationary pressures from the massive increase in the FED’s balance sheet that we have seen. The fourth factor is demographics in the US (strong population growth, levels of consumer spending to GDP , productivity of service and manufacturing sectors) are significantly higher than other G7 countries and significantly higher than Japan at bubble burst.

In terms of whether the FED will buy equity ETFs the way the BOJ has my view is that this is highly unlikely. BOJ only resorted to direct equity purchases after a long period of stubborn deflationary pressure driven by a diminishing available workforce and productivity underperformance relative to its global competitors in most industries barring the auto sector.

Also, in Japan BOJ has effectively taken on the equity unwind of the Corporate sectors cross shareholdings, particularly from the financial sector. The shape of the yield curve has discouraged balance sheet expansion for banks thus unloading of these shareholdings has been of some benefit. In the US because of the enhanced levels of Corporate governance and strong cashflows , the Corporate sector is a net buyer of its own equity in share buybacks.

The Bank of Japan now holds almost 32.25 trillion Yen ($302 billion) or 85% of all Japanese Index-Linked Exchange-Traded Funds

Source: BOJ