“THE NEW GENERATION OF MRS.WATANABES AND INVESTING TODAY IN JAPAN” Part 3

Kenneth Taheny Bio: Ken Taheny, an American has 23 years of experience working in Asia, 10 in Japan. He is Senior Advisor to the Four Ships fund. Most recently, he was MD, Co-Head of Institutional Equity Sales of ICBC International, 2018-2023. Prior to ICBC, he was Director, Head of Asia Pacific Equity Sales Trading, Societe Generale in Hong Kong. He was then Head Of Japanese Equity Sales Trading at MF Global in Tokyo from 2009-2011 and Director of Japanese Equity Sales Trading at HSBC. 2007-2009 Vice President, Japanese Equity Sales Trading, Lehman Brothers 2004-2007, Tokyo.

Yashwant Bajaj Bio: Yashwant Bajaj was Head of Equity Sales Tokyo. Kleinwort Benson Securities Japan (Dresdner Kleinwort Benson from 1997), Japan, Tokyo, 1994 – 1998. He was then MD Lehman Brothers from 1999-2004 where he was Member of Asian Equity Executive Committee. Head of Japan Cash Product and Global Head of Japanese Equity Sales. He then was the Founder and Principal of Hachiman Capital Management 2004 –2010 with 5 years top quartile performance with peak AUM of U$200 million and then Founder and Principal of Juggernaut Capital Management from 2011-2013 that was nominated Best New Asia Hedge Fund in 2012 by Eurekahedge. He started a new hedge fund in 2019, Four Ships, based in Singapore focused on “Japan in Asia Opportunities”.

AV: Is the Yen winner as the low cost, defensive play as the geopolitical landscape shifts from China? If so, then why?

KT: Well I wouldn’t say that the Yen is “the winner” as we believe that there is still room for significant depreciation for the Yen vs the $. That being said, the macro environment in Japan will benefit dramatically from this.

Yash and I have a laugh about this regularly but there are not many people left in the market that remember but $/Y was trading at 250 in the 80’s when Japan was well known as a manufacturing hub. Yash and I might be the only ones left that remember the time when people in the US were concerned Japan was going to take over the world from an economic perspective, raise your hand if you remember the Michael Keaton movie “Gung-Ho”? Back then the story was that the Japanese had new manufacturing methods that were going to change the face manufacturing around the world. While this certainly played a part in the rise of manufacturing in Japan, the primary driver of the rise of Japanese manufacturing in the 60’s70’s and early 80’s was cost. A significant cost advantage driven by a weak Yen.

This dynamic collapsed in a post Plaza Accord world but is set to reverse once again as the Yen depreciates back to the 250 level, yes 250. We believe that Japan will revert to a manufacturing hub over the next 30 years. This will be primarily for goods at the high end of the value-add curve but certainly this is the most significant outcome of the new weak Yen environment we have entered. For those out there that point to Japan’s well documented demographic issues as making this impossible I would suggest that Japan might be the only jurisdiction in the world with the existing technological advantage to nullify those demographic concerns.

The new market environment is one where geopolitics are a major driver of market outcomes. Interestingly, this comes on the heels of a 40-year period where the market barely paid attention to them. This 40-year period of relative calm has resulted in a dynamic where the market does no longer knows how to price geopolitical concerns. There is a long way to go before there is another extended period of geopolitical stasis and it is important for investors to know is that we are likely only in the 2nd inning of what I’ll call the decline of globalization trade. During this period the market will certainly misprice the event risk associated with and the assets that will be impacted by the move towards a bi-polar geopolitical influence world. In this case a weaker Yen satisfies not only an economic outcome for Japan but also a geopolitical outcome for Japan and its allies. This is another catalyst that will facilitate the move weaker in $/Y in the coming years, as far as I can tell the market has yet to recognize this.

AV: Given your stint in ICBC and looking under the hood in China, is the asset allocation overweight Japan due to more underweight China from a top-down macro framework?

KT: Well, that is certainly one part of it. I’ll just say this, every country that has gone through industrialization has come out the other side with a debt issue. In the US the post industrialization resulted in the Great Depression. In Japan we had the “lost decades period”. China is now facing the same issue, a post industrialization bad debt work-off. You can see that the market already knows this, the Chinese bank as a group, trade at the lowest PBR average of any major economy banking sector.

Unfortunately, China will have to go through this debt work-off as the demographic situation globally, not only locally, shifts. Because of this and other more idiosyncratic concerns our view is that China will go through an almost carbon copy like debt work off as the Japanese economy did in the 90’s and 00’s.

From an asset allocation perspective, the flight of foreign capital out of China is well underway. You can easily see it in the performance of Indian Equities vs China/HK Equities this yea. That phenomenon is caused by capital bench marked to EEM flowing to new jurisdictions in the EEM Universe. This is likely to continue for an extended period as investors rationalize the debt work-out and other structural issues in the Chinese economy .Japan will be a beneficiary of this as some of the capital that leaves China will end up there. This is not only true of the equity ecosystem but also other asset classes and opportunities.

AV: From our last interview (Interview-Part 2),the decline in Dollar/ Yen was primarily due to current yield differential and current account weakness, is this still the case from a fundamental perspective and how does the Yen / RMB impact this?

YB: The yield differential is the main driver. We are not at a point where booming exports will drive a J Curve reversal, this would require a significant further depreciation in our view before this becomes a factor. In addition, as Ken points out, there are significant geopolitical factors guiding the pathway down. A new “cold war” where Japan reestablishes its importance in this construct. Its role as a high tech supply chain partner obviates what would previously arouse a furore regarding devaluation of the yen. With respect to the RMB we are due for a rough ride notwithstanding the scale of China's FX reserves the longer the debt workout in real estate / Local government financing vehicles is left the harder it will be to avoid capital flight and a suspension of inward investment.

AV: Prime Minister Fumio Kishida recently announced fiscal policy measures to counter inflation such as corporate tax incentives, wage hikes and income tax cuts. As fiscal policy measures are negative for risk assets, will this boost Japan’s underweight position along with your reasons: persistent deflationary pressures, aging population and marginalization of Japanese companies in industries by Asian competitors leading to lower comparable growth?

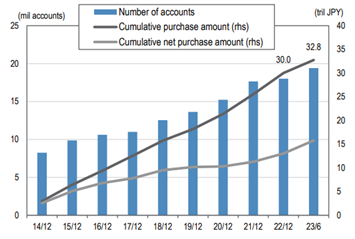

YB: Rather the reverse, in the current inflationary backdrop with persistent inflation above the 2% target but, not significantly above it from an economic management perspective unlike other G7 economies where this is well above this level, has created an environment where the zero interest policy of BOJ may finally achieve some flow from savings to risk asset investment: Certainly the measures regarding wages, and the Spring labor offensive ( Shunto ) looks to be landing at near 5% with some companies already agreeing to 7% will create real disposable income. At the same time measures to encourage stock market investment such as the increase in size and duration allowance for NISA (Nippon Individual Savings Accounts) accounts in January should facilitate some of this money finding its way into tax-efficient savings in equity funds. Likewise, tax cuts facilitate this allocation. Before you groan at the repeated claims of the prospect of risk assets being bought from diverted savings or new income, the growth in NISA accounts has been steady in the past 5 years

Source : Japanese FSA

In terms of structural deflation, we believe that we are at a real potential inflection point away from deflation: the devaluation of the yen coupled with the fiscal and corporate wage measures has created a framework that supports this. The final part of this is BOJ policy. Thus counter to current consensus we believe that BOJ will not hike significantly in 2024- the ZIRP started by Kuroda-san aim was to end deflation and we do not believe that they will squander this opportunity 20 years on in response to inflation 100 basis points above target currently. A steep hike in rates is also out of the question given BOJs own holding in the JGB market and Japan's debt to GDP of 350%.

AV: As the manufacturing sector passes higher costs to end consumers and with continued deleveraging story, will valuation catch up to fundamentals in Japan and how does your Outside In approach at Four Ships benefit?

YB: The experience in the US and Europe with respect to consumers who have achieved wage hikes in response to inflation has been surprisingly elevated levels of consumption. This is likely to be the outcome in Japan as well in the 1H of 2024. Japan has kept a relatively low valuation level to other mature markets thus this both allows some rerating higher when this occurs and also offers some valuation support if we see an external recessionary environment.